Recent market status and trends of fractionated plasma products

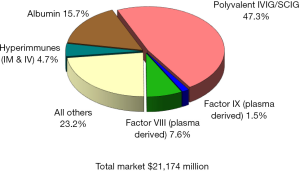

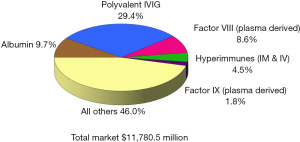

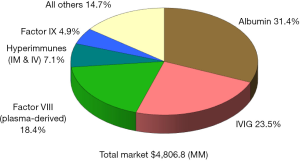

Since the beginning of the 21st century the global plasma proteins market has continued to grow at a steady pace, reaching over $21 billion in 2016 (Figure 1), up from $11.8 billion in 2008 (Figure 2), and $4.8 billion in 1996 (Figure 3) (1). This growth has been driven by increasing usage of nearly every plasma-derived medicinal products (PDMPs), as more patients were able to benefit from these therapies in a growing number of countries. However, this progress has not been uniformed across all products or countries, as the use of some products increased faster than others and some markets experienced recent growth. In the past decade, the plasma proteins industry has been significantly affected by the following five events:

- Strengthening of immunoglobulin as the plasma market driver;

- Rise of China’s plasma industry, both domestically and globally;

- Emergence and growth of several specialty products;

- Relative decline of the plasma-derived coagulation factors in favor of recombinant products and novel technologies;

- Increasing importance of the United States as the plasma supplier for the world.

Strengthening of immunoglobulin as the plasma market driver

Polyvalent immunoglobulin G (IgG) were originally developed in the 1950s and administered intramuscularly to treat patients with primary immune deficiencies (PID), but the limited volume which could be injected through this route restricted their efficacy and acceptance, and thus, their market. In the 1980s, the technology to purify fully intact IgG had advanced enough to allow for its intravenous administration, significantly enhancing its efficacy and convenience. From this point onward, the IgG market expanded rapidly as it was soon found that it could be used to treat other disease conditions besides PID. From the early 1990s, IgG became the most important protein from a commercial perspective in the global plasma fractionation industry. In 2016, sales of polyvalent IgG, both intravenous and subcutaneous, represented 47% of the global plasma protein market, up from about 20% in 1984, 24% in 1996, and 46% in 2008. This sales growth was primarily attributed to product usage to treat conditions established for a number of years, including PID, Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and Guillain-Barré syndrome (GBS). New indications contributed to some of the demand growth, such as multifocal motor neuropathy (MMN), but attempts to treat some other conditions with IgG have failed. The most notable failure in recent years has been the clinical trial of IgG to treat Alzheimer’s disease. Despite some promising small scale and retrospective studies, the largest multicenter phase III study conducted by Baxter (now Shire) and completed in 2012 did not show statistical efficacy to slow or reverse Alzheimer’s disease (2-5). Even though several studies to treat Alzheimer’s disease are still on-going today, the focus of future indications for IgG has moved to autoimmune conditions such as myasthenia gravis, post-polio syndrome and inflammatory myositis, among others (6,7).

As sales of IgG represent almost half the sales of all plasma proteins, the volume of plasma needed to meet the global IgG demand determines the volume of plasma that the industry collects and fractionates. In other words, the industry collects plasma based on the anticipated demand for IgG. Since other therapeutic proteins (PDMPs) can be made from the same plasma through the fractionation process, the fractionators will process as much plasma as they can, up to the last liter that they can sell as IgG. Thus, in plasma economics, IgG is the key “last liter” product, while albumin is the secondary last liter product. Albumin represents about 15% of global plasma proteins sales in 2016, almost unchanged from 2008.

IgG’s market success in the 2010’s has strengthened and even increased its importance as the market driver. IgG sales are expected to continue to grow at a consensus rate of 6–8% in volume annually in the next several years, as demand and usage in many countries increases because more patients are identified, funding for treatment becomes available spurred by patient groups’ advocacy, and awareness and appreciation of IgG therapies increase in the medical community.

Rise of China in the global plasma industry

In the past 6 years, the plasma proteins market in China has eclipsed Germany to become the second largest global market by sales, behind the United States. Between 2009 and 2015 (latest data available), the Chinese plasma proteins market gained over 200% to reach about $2.4 billion. As the Chinese plasma companies expanded their collections and fractionation to meet the fast-growing domestic demand, sales of nearly all proteins increased. In contrast to western countries, albumin was the marker driver, and its sales represented about 64% of the total plasma proteins market in 2015. The high albumin usage in this country is attributed in part to cultural preferences (albumin is considered an energy supplement in China), and in part by the aggressive commercial promotion and distribution of albumin and its wide availability, facilitated by imports. The Chinese albumin market is the largest in the world, representing almost half of global sales in dollars, partially due to one of the highest prices per gram (over 5 dollars). As the Chinese plasma proteins market continues to grow at a higher rate than the world’s average, its influence on the global supply and demand of plasma products is increasingly felt, particularly with regard to albumin, affecting its pricing and availability.

Another way that China has begun to impact the global plasma proteins industry has been through the acquisition of plasma companies outside China. In May 2016, the Chinese investment group CREAT bought Bio Products Laboratory (United Kingdom) for £820 million ($1.2 billion) (8). The CREAT group already held a large stake in Shanghai RAAS, a Chinese plasma fractionation company. Nearly a year later in April 2017, the CREAT group announced plans to acquire Biotest AG (Germany), for €1.3 billion ($1.4 billion) (9). These acquisitions of western plasma fractionation companies signal a global view of the plasma industry by Chinese investors. Similarly, a growing interest of western companies for the Chinese market was signaled by the acquisition, in June 2017, of a Chinese-based fractionation company (Wuhan Zhong Yuan Rui De Biologics) or Ruide for $352 million by CSL Ltd (10). Even though CSL will not be able to integrate Ruide in its global production network in the same way as its other facilities, due to Chinese limitations on the import and export of plasma, this acquisition constitutes nonetheless a significant effort to participate in the growth of the Chinese plasma proteins market beyond the importation of albumin. Even though the result of these investments by global companies and Chinese investors has not been completely felt around the globe, these moves and market trends testify to shifting opportunities and focus within the global plasma protein market.

Commercial growth of specialty plasma proteins

Along with the growth of IgG sales, some relatively new specialty plasma proteins have had a significant impact on the market in the 2010s. In 2010, the sales of C1 esterase inhibitor (C1-INH) for the treatment of hereditary angioedema (HAE) amounted to about $200 million globally. This was 1.5% of total plasma proteins sales because the product had just been just launched in late 2008 in the United States, and European sales were limited by the product’s approval confined to only a few countries. By 2016, the sales reached over $1.1 billion (5.2% of global PDMPs sales), as the product gained rapid acceptance mainly in the United States where the awareness of treatment and diagnosis of HAE were boosted by Shire and CSL Behring. As a result, C1-INH became the fourth largest plasma protein in terms of dollar sales worldwide, behind IgG, albumin and plasma-derived factor VIII. The market for C1-INH is continuing to grow strongly, and it is likely to increase its share of total plasma proteins sales in the future as a new formulation for subcutaneous injection will further facilitate product adoption. In addition, C1-INH is under investigation for transplant where antibody mediated rejection (AMR) has occurred (7).

Other specialty products which continue to grow at a stronger pace that the industry overall include prothrombin complex concentrate (PCC) as well as alpha-1 antitrypsin (AAT). Global sales of AAT reached $1.0 billion in 2016, or 4.7% of the total market. This is up slightly from 4.1% of sales in 2010, as the market in the United States has sustained approximately a low two-digit annual sales growth for the past 6 years, driven mostly by new patient identification and higher dosing. Most of the global AAT sales are generated in the United States, though sales of this therapy in Europe are trending upward after approval through the central European Medicines Agency (EMA) process of a new product in August 2015. AAT is also under investigation for new indications, such as graft vs. host disease after hematopoietic stem cell transplantation (HSCT) as well as type 1 diabetes (11,12). If either of these areas show clinical trial success, the market would be expected to experience higher new demand for the therapy.

PCC products have nearly reached the $500 million in sales mark in 2016, up from under $300 million in 2010. This impressive growth was due to the introduction of the first four-factor (factors II, VII, IX and X) coagulation product in the United States by CSL Behring in 2013 for the urgent reversal of vitamin K antagonist (VKA) anticoagulation in adults with acute major bleeding. Sales of this product reached close to $200 million within four years of product launch. Sales also increased in Europe for the same indication, while little PCC is used in other markets around the world at present.

These results illustrate that the plasma industry is still capable, after more than 60 years of existence, to market new proteins that are of significant clinical importance and are commercially successful. It is expected that, in the long run, some of the basic proteins (IgG, albumin and coagulation factors) will be gradually and partially replaced by monoclonal antibodies, recombinant products, gene therapy or by medical procedures, and that their sales will erode. The revenues obtained from these new plasma proteins will in part make up for the anticipated revenue losses. Other specialty plasma proteins such as antithrombin III, von Willebrand factor, fibrinogen and protein C have shown more stable sales over the past 5 years.

Emergence of novel therapies in hemophilia

In the past 5 years, the hemophilia markets in the high-income countries have experienced more changes than the previous 30 years, due to the rapid introduction of a number of new products for hemophilia treatment. As the understanding of the coagulation cascade has become better understood, scientists and companies have developed ever-more advanced ways to control it, resulting in many new products. The first notable change was the introduction of the first extended half-life factors VIII and IX products by Biogen (now Bioverativ) in 2014. Since then, other extended half-life factor products have been introduced by Shire, CSL Behring and Novo Nordisk, with several more in late-stage development. In addition, Roche received Food and Drug Administration (FDA) approval for the first novel, non-factor therapy to treat hemophilia patients with inhibitors in November 2017 (13). This is the first monoclonal antibody to treat hemophilia patients and the first therapy to be injected subcutaneously. At the same time, many companies are pursuing gene therapy for both hemophilia A and B, with some notable successes in early stage clinical trials (14,15). Given these successes, gene therapy is likely to be commercially available in the near future, perhaps as early as 2020, making its impact on the next decade.

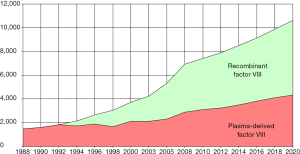

As a result of these innovations and the availability of new products, the market share of plasma-derived products has decreased in many markets, continuing a trend observed since the 1990s, as the “standard” recombinant coagulation factors pushed out the plasma-derived equivalent to other, low income markets (Figure 4). In the United States, the market share of the plasma-derived factor VIII percent of sales fell from 11% in 2010 to 9% in 2016, while the share of plasma-derived factor IX products fell from 20% to 6% in units. The latter’s market share drop was due to the faster adoption of the extended half-life factor IX products than those of factor VIII, because they offer longer intervals between infusions than the standard recombinant and plasma-derived products. Globally, the plasma-derived factor VIII market share went from 27% in 2010 to 21% in 2016. For its part, the plasma-derived factor IX’ market share fell from 34% in 2010 to 21% in 2016.

Even though the market share of plasma products has decreased during this decade, the total demand in units has increased, as the worldwide market of plasma-derived factors VIII and IX rose over 30% in 6 years for each product, due to the growing demand primarily from low income countries but also as an immune tolerance treatment for patients with inhibitors to factor VIII or IX. This demand growth has been spurred in part by falling prices of factor products, as economies of scale have lowered costs.

Global plasma supply for fractionation and the role of the United States

As the production of IgG has increased over the past decades, so has the need for more plasma. From about 16.4 million liters available for fractionation in 1990, and 33.6 million liters in 2010, the global supply of plasma for fractionation (source and recovered) reached an estimated 51.2 million liters in 2016. Of this, two thirds consisted of total plasma from the United States. More specifically, 74% of the global source plasma came from the United States in 2016. This country is able to generate a higher volume of source plasma than other countries because the FDA allows an individual to donate plasma more frequently and at a higher annual volume than any other country. The donor compensation, while significant, is not the main factor for the United States preeminence in this area.

Over the past few years, source plasma has represented a growing share of the global volume of plasma for fractionation, going from 67% in 1996 to 84% in 2015 (Table 1), mainly attributed to a steady increase of source plasma collections, and to a small extent, the erosion of the volume of recovered plasma for fractionation.

Table 1

| Year | Percentage |

|---|---|

| 1996 | 67% |

| 1999 | 68% |

| 2002 | 69% |

| 2004 | 67% |

| 2007 | 70% |

| 2010 | 76% |

| 2012 | 76% |

| 2015 | 84% |

Source: Marketing Research Bureau, Inc.

Until about 2012, the supply of source plasma was met by a relatively constant number of plasma collections centers in the United States, the number of which averaged about 400 between 1995 and 2013. This occurred despite the fact collections were growing to match the increased demand for IgG. Presumably, this was possible because the centers were expanded by the addition of donor beds and more efficient usage of facilities. However, by the early 2010s, the growing need for plasma could no longer be met by existing collection centers, and new collection centers had to be opened. In 2014, the number of United States plasma centers increased to 484, then 558 in 2016, and over 650 were expected at the end of 2017. In recent months, several fractionators have announced or began to implement ambitious plans for opening new collection centers to meet future market needs, so this number is likely to rise in the next few years. As the global need for source plasma continues to increase and recovered plasma supply continues to slowly decline, increased pressure is put on the United States collection efforts, creating an increasingly lopsided global collection system, and calling for a diversification of source plasma supply.

As a result of recent fractionation plant expansions and new constructions, the global annual fractionation capacity reached an estimated 70.7 million liters in 2016, a volume significantly higher than the throughput but the reported capacities are not fully in operation and are put in service over time as needed.

When taken together, some of the trends above are extensions of those which began in previous decades. IgG will continue to drive plasma collections and fractionation, as will the United States be the epicenter for source plasma collections. China’s rise to prominence as a market and source of capital may become an important factor of change going forward. The commercialization of new plasma-derived therapies is expected to record significant growth into the new decade. Due to competition from novel product, plasma-derived factor products will further lose market share although their demand in units will continue to slowly grow.

Acknowledgments

Funding is provided through the employment of both authors by the Marketing Research Bureau, Inc.

Footnote

Provenance and Peer Review: This article was commissioned by the Guest Editor (Thierry Burnouf) for the series “Plasma Fractionation” published in Annals of Blood. The article has undergone external peer review.

Conflicts of Interest: Both authors have completed the ICMJE uniform disclosure form (available at http://dx.doi.org/10.21037/aob.2018.01.06). The series “Plasma Fractionation” was commissioned by the editorial office without any funding or sponsorship. Matthew Hotchko and Patrick Robert both are employed full-time by the Marketing Research Bureau Inc., where they are plasma proteins market experts with consulting for many plasma fractionation companies and others interested in the plasma proteins industry.

Ethical Statement: The authors are accountable for all aspects of the manuscript and ensure that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved.

Open Access Statement: This is an Open Access article distributed in accordance with the Creative Commons Attribution-NonCommercial-NoDerivs 4.0 International License (CC BY-NC-ND 4.0), which permits the non-commercial replication and distribution of the article with the strict proviso that no changes or edits are made and the original work is properly cited (including links to both the formal publication through the relevant DOI and the license). See: https://creativecommons.org/licenses/by-nc-nd/4.0/.

References

- Robert P, Hotchko M. Worldwide 2016 Plasma Protein Sales - Marketing Research Bureau, Inc. Published December 1, 2017.

- Science Daily. Results Of 9-Month Phase II Study Of Gammagard Intravenous Immunoglobulin. (Published 30 June 2008, accessed 15 December 2017). Available online: http://www.sciencedaily.com/releases/2008/07/080730175522.htm

- Medpage Today. IVIG Stops Alzheimer's in Its Tracks. (Published 17 July 2012, accessed 15 December 2017). Available online: http://www.medpagetoday.com/MeetingCoverage/AAIC/33780

- Dodel R, Rominger A, Bartenstein P, et al. Intravenous immunoglobulin for treatment of mild-to-moderate Alzheimer's disease: a phase 2, randomised, double-blind, placebo-controlled, dose-finding trial. Lancet Neurol 2013;12:233-43. [Crossref] [PubMed]

- Medpage Today. Alzheimer’s Disease: IVIG Fails in Trial. (Published 7 May 2013, accessed 15 December 2017). Available online: http://www.medpagetoday.com/Neurology/AlzheimersDisease/38939

- Grifols Investor and Analyst’s Meeting. (Published 7 June 2017, accessed 15 December 2017). Available online: http://www.grifols.com/en/web/international/investor-relations/presentations

- CSL R&D Investor Briefing. (published 5 December 2017, accessed 15 December 2017). Available online: http://www.csl.com.au/investors/briefings-presentations/operational-briefing.htm

- BPL press release. (published 19 May 2016, accessed 15 December 2017). Available online: http://www.bpl.co.uk/about-bpl/news/q/date/2016/05/19/press-release-creat-group-corporation-agrees-to-acquire-bio-products-laboratory-ltd/

- Reuters article. (published 7 April 2017, accessed 15 December 2017). Available online: https://www.reuters.com/article/us-biotest-m-a-creat/biotest-agrees-to-takeover-by-chinas-creat-in-1-3-billion-euro-deal-idUSKBN1791RC

- CSL Limited press release. (published 13 June 2017, accessed 15 December 2017). Available online: http://www.csl.com.au/investors/Acquisition-of-a-Chinese-plasma-fractionator.htm

- Pavan R. A Pilot Study of Alpha-1-Antitrypsin (AAT) in Steroid Refractory Acute Graft vs Host Disease. (published 4 October 2012, accessed 15 December 2017). Available online: https://www.clinicaltrials.gov/ct2/show/NCT01700036?term=NCT01700036&rank=1

- Aralast NP in Islet Transplant. (published 11 August 2015, accessed 15 December 2017) Available online: https://www.clinicaltrials.gov/ct2/show/NCT02520076?term=NCT02520076&rank=1

- FDA press release. FDA approves new treatment to prevent bleeding in certain patients with hemophilia A. [published 16 November 2017, accessed 15 December 2017). Available online: https://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm585567.htm

- George LA, Sullivan SK, Giermasz A, et al. Hemophilia B Gene Therapy with a High-Specific-Activity Factor IX Variant. N Engl J Med 2017;377:2215-27. [Crossref] [PubMed]

- Biomarin press release. (published 11 December 2017, accessed 15 December 2017). Available online: http://investors.biomarin.com/2017-12-11-BioMarin-Highlights-New-Results-for-Gene-Therapy-Valoctocogene-Roxaparvovec-at-the-2017-American-Society-of-Hemophilia-ASH-Meeting

Cite this article as: Hotchko M, Robert P. Recent market status and trends of fractionated plasma products. Ann Blood 2018;3:19.